mind, because were gonna talk about health insurance.

[INTRO] Health insurance can be a super confusing

and frustrating thing to deal with. But its a huge part of adulting! Since we dont have a crystal ball for how

the future of American health care will turn out, we wont be talking today about what

kind of public or private health care plan options might be available to you. Instead, this will be a primer on the very

basics of health insurance for an individual, regardless of where your insurance is coming

from. Now, the next time youre choosing a plan

or someone asks you how it works, it wont all seem like some alien language.

First up, lets talk about your insurance

policy that youll buy from your health insurance company. This is the plan that says how much youre

paying and what kind of services the insurance company will pay for, including routine checkups

and emergency care. Insurance policies usually last for one year

and youll typically sign up for a new one around December or January, unless your employment

or life changes. Many health insurance policies exclude dental

and vision coverage, so youll need to buy an additional policy to cover those things

if you have, uh, eyes and teeth.

[Laughter, because what else?] When choosing your insurance policy, its

really important to understand how much your premium will be. The premium is how much you pay each month

for the service, just like Netflix. If you get your health insurance through your

company, they might automatically deduct the payments from your paycheck. If you signed up for a plan through the Affordable

Care Act or a private insurer, youre in charge of remembering to pay the premium each

month.

How much your premium costs will be largely

related to your deductible. The deductible is how much you have to pay

for your health care before the insurance company will start reimbursing claims, the

bill for the service. Usually the doctors office or hospital

that you went to will send the claim, aka the bill, directly to your insurance company. If your deductible is high, like, say, six

thousand dollars, that means you will have to pay out of pocket for six thousand dollars

worth of services before your insurance kicks in and starts reimbursing claims.

But! Even if you havent met your deductible,

most insurance plans do cover almost all of the costs of routine preventative care, like

getting a yearly checkup or a gynecological exam. Pretty much every plan defines routine care differently,

so its a good thing to read up on when picking a plan. They make it really confusing. The type of health insurance company youre

buying a plan from might make a difference when it comes to choosing which doctors you

can see.

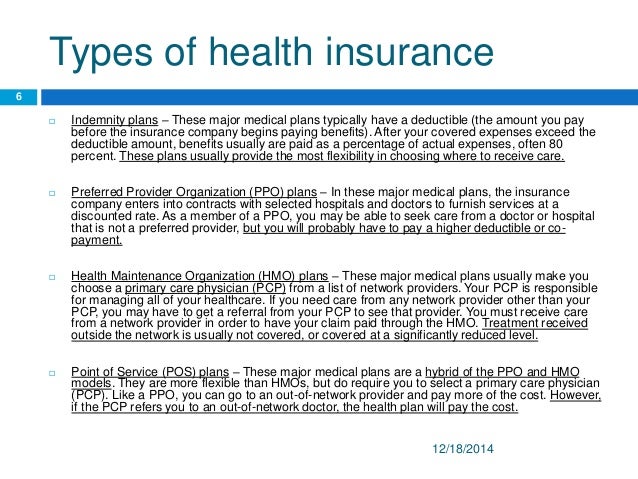

If youve ever heard of HMOs, AKA health

maintenance organizations, they only cover procedures performed by certain professionals

in a network. Youll want to make sure that the doctor

you go to is in network for your HMO. But wait! If your health insurance comes through a PPO,

or a preferred provider organization, that means theyll cover your doctor visit at

different rates depending if that doctor is in-network or not. Whether you get health insurance through an

HMO or a PPO, make sure you know whether your doctor is in network and prepare to shell

out accordingly.

If its hard to figure out by googling,

you can usually just call a doctors office and ask them if they can work with your insurance

plan. After you sign up for a health care plan,

the company might require that you choose a primary care provider. Lucky you, we made a whole entire video for

this already! When you go to a clinic or hospital for any

kind of care, you may need to break out your wallet for a copayment, which is a fixed amount

expected to be paid to the doctors office when the service is rendered. So lets say that youve spent enough

on health care this year that you meet the cutoff for your deductible.

Awesome. Insurance will cover everything now, right? Well, not quite. You might still need to pay coinsurance on

any additional doctors visits for that year. Coinsurance is usually a percentage of the

bill, not a fixed amount.

Health insurance companies sometimes describe

it as your share of the costs of a health service, because yay, dont we all love

sharing. So, we could go on about how healthcare works

for a ridiculously long time. But ultimately, the most important thing to

understand about your health insurance plan isas much as you probably don't want topay attention. Health insurance is weird and complicated

and the companies themselves do not always get everything right, and mistakes can happen

when it comes to billing for claims.

Read your plan when you sign up, read the

bills when they come in and make sure that your insurer is covering everything they are

supposed to pay for. If you go to the doctor and then suddenly

get a bill for a service you thought was covered, do your research and be prepared to fight

for what you deserve. The best way to resolve a conflict over an

insurance bill is usually to call up the company and ask for a real live human to help you

solve the problem. Politeness goes a long way when dealing

with insurance companies.

And remember, breathe deeply. [Breathing deeply] You got this. Thank you for joining us! If you want to learn more about adulting with

Rachel and me, you can subscribe to How to Adult at youtube.Com/learnhowtoadult And if you liked this episode and want to

support this channel, consider becoming a patreon patron at patreon.Com/howtoadult guided meditation with Hank. I'm going to get right down in the microphone...

That'd be a good... P4A perk. Yeah. Guided sleep meditation with Hank.

[Off-screen]

ASMR. [Off-screen]

Hank's AMR... AMR. Hank's arm.

[Laughter] My arm talks to you about sleep. It'd be really hard to send that to you in the mail. [Laughter] You can't have my arm! Anyway, let's do this thing. Before my legs fall off.

Eventually this is not comfortable anymore. [Off-screen]

Yeah, you can de-pretzel. De-pretzel. Deep pretzel.

Deep pretzel: IBM's new supercomputer. Yeah. [Laughter] [off-screen]

It's got a built-in food court. Read yourread your plan when you sign up.

You messed me up. Our eyes met! [Laughter] Read your plan! Noooooo! It's too long!.