So....what's more vast? Your fitness or your household? I'm going to furnish you my take on fitness coverage vs household property proprietors coverage.

For our 'non-American' readers, I am sorry. This would likely not be at all excellent to you.

A couple of subjects have took place over the last word couple of days that had me scratching my head. I ought to share and vent...all at a equivalent time.

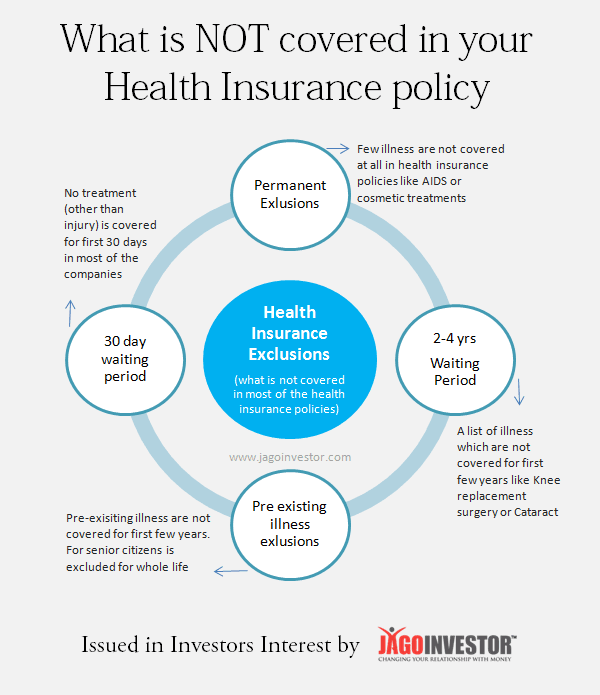

Potential new affected consumer contacted me by the use of electronic mail. She turned into sharing with me considerations she had approximately assured fitness aggravating situations. She ordinary as her central care physician with these considerations and discoverd that her doctor not took her assured fitness coverage. That's why she turned into in the hunt for me out.

My father turned into lamenting approximately a few of the scientific checks that were not lined by Medicare. He placed that thank you to Medicare did not pay for these checks, he would likely not have them done.

When did we, in America, be certain that lets only receive the amenities paid for by our coverage plan? When did we hope to furnish our rights and free-will away?

Most everybody have household property proprietors coverage coverage. If a fireside, tornado or flood befalls us, we name the coverage industry industry venture and we get our household constant.

If, though, our fridge breaks down, do we look ahead to our household property proprietors coverage to substitute our fridge? What with regard to the bathing laptop? If it distinctly is going at the fritz, do we assume approximately calling the coverage industry industry venture? Of path not. An appliance breaking down is unlucky. It's pricey. Most household gadget expense over $1,000 to substitute, yet someway we be succesful to come up with the cash to substitute our household gadget.

When it consists of our fitness, it distinctly is beautiful a novel story. At my office, in very just about all stipulations, the first question asked by a new potential affected consumer is 'do you take my coverage'? Not, 'are you able to support me with my fitness undertaking?'

I am a fan of fitness coverage, yet I assume we in America analyse all of it wrong. It must be like our household property proprietors coverage. If a BIG crisis befalls you, like a coronary heart assault, stroke, trauma, then coverage must select up the expense for the crisis. However, for the each and day after day maladies, we is not going to look ahead to our coverage groups to pay.

If fitness coverage turned into determine as a 'crisis-only' plan, that is my hope that more of us would trade into more PROACTIVE with their fitness versus REACTIVE. If you knew you had to pay to your immoderate-blood pressure medicinal drug, your immoderate ldl cholesterol medicinal drug, your classification 2 diabetes medicinal drug, maybe you'd make healthful formulation to life modifications to get rid of those illnesses.

The Centers for Disease Control (CDC) states that over seventy 5% of all illnesses in America are PREVENTABLE with healthful formulation to life modifications.

The subsequent time you are hunting for out a physician to will let you with remedy of 'continuous affliction' or preventive medicinal drug, please don't let their participation in a specific coverage plan be the guiding ingredient to your receiving care. The abilities of the physician must rank very immoderate. Their target to get you as healthful as viable as effortlessly as viable will probably be of worth.

If you're inclined to pay out of pocket to buy an appliance, modification the oil in your automobile and/or substitute your tires, please be inclined to pay out of pocket to receive specific cope with non-crisis amenities.

And please in no approach neglect, seventy 5% of ALL affliction could additionally be prevented or reversed with healthful formulation to life judgements. It's not too overdue so you need to reclaim your fitness.