All right! Well this is Mark Sequeira at Good Neighbor Insurance, and today we are going to be talking to one of our specialists in self-funding, and partial self-insuring,

partial self-funding. Dale Bear, so welcome Dale. Thank you for joining us today. Hello Mark.

Good to be here. It's a great day. Yeah! Always technical difficulties with Google Hangout, but that's all right. It's wonderful to see you and I know we've been keeping you busy, and you've been busy, so thanks for taking your time.

Today specifically, I know that we wanted to speak a little bit to our clients and potential clients about reinsurance, and stop-loss insurance. So, maybe you can start if somebody is frankly pretty new to this whole concept, just tell us a little about what that is, and why somebody might use it. Well, you mentioned at the front that we're dealing with partial self-insured, and I call it that whether you're at, your deductible's $150,000 or your deductible's $2,000, so today, we're mainly going to talk about

the higher end of that, what most people would consider self-funding their group, but just so they understand, that would involve where they're paying the main claim up to a spec level, it's what we call a

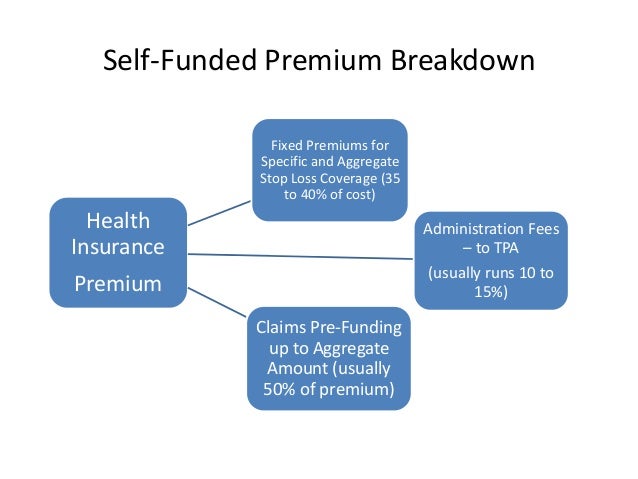

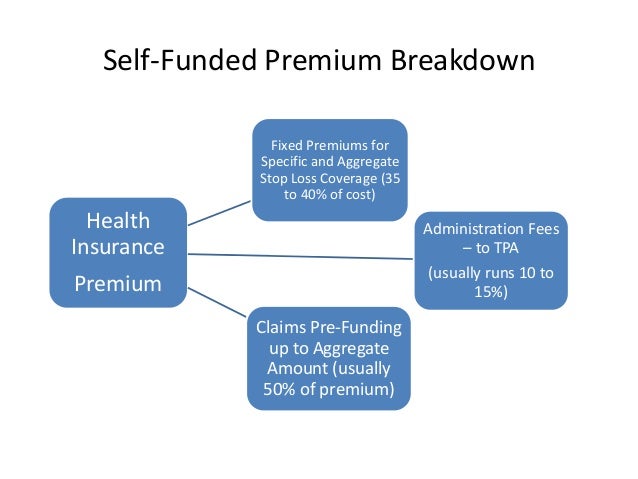

spec, or a reinsurance level, where you're actually then buying insurance to cover the rest of that. There's three main pieces, I guess I would say, to self-funding.

You have your part of whatever you're gonna pick, that you're going to actually pay for

yourself. You have a TPA that handles that for you:

third party administrator. They're the ones that will actually do your claims, as far as your employees are concerned. They'll be considered the insurance company, so when it says, when you say something like under a fully insured plan, well Blue Cross paid, Well in this case whoever your TPA is will become that name, so as far as your folks are concerned, that will be your insurance company.

As part of that, they may use a PPO, a preferred provider organization, or someone that gets discounts. So you might also refer to your plan under that, and then finally we would have a reinsurance company, that we would buy for high risk, for catastrophic loss, and those would be seamless, behind the scenes, as far as reinsurance carriers. The only ones that would know about that would be yourselves within your contracts. So, on self-insured, you basically handle all your claims for anybody up to whatever deductible you choose that makes sense for you.

It's done by a third-party administrator if those claims go over a certain amount, over a certain deductible, then that reinsurance company kicks in and pays the remainder. And that's a very simplified picture of self-insured. So, let's talk about risk a little bit. So, when we're talking self-funded, obviously since these people are basically insuring themselves.

The stop-loss if somebody has a claim, they find out they have stage two cancer or something. It's going to be very expensive. At that point, this re-insurance is gonna kick in at $50,000, $100,000, whatever for that person, to take anything after that and pay it? Yeah, depends on the contract and how you do it. You can, you know there's even aggregating specs, or aggregating specifics.

But, that's getting a little complicated so let's just talk about, let's just take for example a large claim like you just mentioned, let's say it is someone that's gonna run a $400,000 bill. Let's just put it that way. And you're self insuring, as a company, you know, what's that gonna look like? And let's just use for an example, let's say you set it up and you have a third-party administrator. And you have a PPO network, let's just name one of them out there, let's say you use First Health.

Unless you use one of the major companies out there that's doing yourself funding, you have to use a rentable PPO, someone that will allow you to rent their network without them doing your claims also. So you're going to do something like a First Health, or like a PHCS, or a multi-plan, Med Cost, there are several units out there that are PPO networks. So you've selected that. What happens on it, and you've also selected your reinsurance, so let's say in this case your reinsurance is going to kick in at a $100,000 if you have a claim.

So this large claim comes through, the claim goes to your TPA, well it usally goes first to the PPO, to get repriced, to the network, they'll usually reprice the claim, then it goes to the TPA, the TPA will pay it. What they will do, the TPA does the technical work for you, so they send you the bill for the first $100,000. You're expected to pay that. That's one of the things with self-insuring, you have to make sure you have plenty of reserves and cash flow because like this, a big claim that gets in one month, you've gotta pay that $100,00 in one month, let alone the other claims that are coming in that month.

So

sometimes cash flow can be a problem. So you'll pay the $100,00. The TPA will actually verify that in fact this is a claim that hits the $100,00 spec. They send that to your reinsurance carrier, whoever that might be, say HTC or might be, Employers Reinsurance Corporation, etc.

There's a lot of, White Mountain Reinsurance, there's several, Lloyd's of London. They're all reinsurance companies. And they will look at it, they will verify that in fact it hits your spec, and then they will basically take over the claim at that point for the period of your contract. So once you hit the $100,000 spec with that employee, now they will pay 100% of the rest the claim for whatever the contract is and let's say it is an ACA compliant plan that you set up, which you have to because you're in a plan with a self-insured plan.

So it's unlimited, but the only limitation you'll have on it is the annual contract period. So let's say, let's keep it simple, let's say you have a January-December contract period. And this happens in July. So in July you have, the claim comes in several pieces, so let's say it comes in,

the first few hundred thousand.

So you paid 100, reinsurance carriers now

paid 100. They will continue paying any claim on that employee until December 31st when you renew. That brings up some other interesting things with self-insured that you have to make sure that you have done right in the area of contracts. You want to get in the contracts now? Of how reinsurance contracts, etc? Is that something you'd be interested in? That we might have to hold for another

day.

And/or have people call you obviously, because I know this is a vastly complicated field, and I'm sure you would tell people that they shouldn't be trying to necessarily do this on their own. I think that... Well some people fear large claims like we just talked about. But, in reality, one large claim isn't too much of a problem.

If it's an ongoing claim, it can be a problem on renewing your reinsurance In some cases the reinsurance may laser out a particular employee of yours. For instance, let's take the same example

we had. Let's say this is an ongoing cancer case and it's not going to end on January 1st. If you haven't been careful with the reinsurance company that you've shopped for, they may come back to you and say, okay, next year we will renew for January through December, at this rate.

They give you a rate that's close maybe to where you had before, maybe a little up, depends on the rest of your claims. But then they say on this specific employee, we're going to laser him out. And that may mean that they say you have to stay in the first 300,000 on him. Then we will kick in after that.

That's called lasering and they can do that, and they do do that. But part of the thing

when you set it up, you want to be careful that you get a company that either guarantees you that they won't laser, and sometimes that has to do with the size of your group.. Frankly, you may not be able to do that, so you may just have to be aware of that. The problem with laser renew is you're stuck, because at that point when the claim is happening, you can't go anywhere else.

You can't go to a fully insured carrier at that point. You can't go to another reinsurance company. So if you do get lasered with a claim, in that example then you're going to have to pay the bill, and if they say we'll laser to 400, You just hope that the person is not going to have that much treatment the next year. Because what can happen is, you'll pay

the first $400,00 of claims.

Let's say he has half a million in claims the

next year. You will pay 400, then the reinsurance carrier will kick in and pay an additional 100. And that will make your self-insured health plan look pretty bad. It can be very high.

That's why we also get in the area of talking about reserves and having your eyes open before you go into a self-insured plan. Now, I'm bringing up some real problems there Mark, because as a whole, you don't have that happen. I would say probably you know, maybe 1 out of 20 have ever even know what a laser is, that are doing self-insured. But you just got to make sure that guys who set it up for you are professional and know what's going on with it.

So, that's why you wanna ask the questions, and know what's going on before you jump into something that later on you don't want to have a "gotcha." Yeah, and this I really appreciate that. That's one reason why we love working with you, and we recommend you to our clients. And one of the things practically that partial self-insuring or partial self-funding as we call it. It's really going to protect against some of that if they're concerned about those kinds of issues.

That way they're not gonna, that's not going to happen to them. Explain a little bit more, and we're a going to talk about reserves as well, in another hangout here. But explain to me, my be define for myself, our listeners, aggregate stop loss versus specific stop loss. Ok.

There's different terms floating around. Yeah, it's a, you know those are technical terms. But let's go back to our example. We were buying $100,000 of reinsurance.

So the reinsurance kicked in at $100,000. Let's say, and you remember I just talked about, if you have one large claim it's not too bad.

It's not going to hurt you. But what happens if you have ten. Let's say your group is 200 in size: 200 units.

And let's say you have 10 claims that come in that are over $500,000. Now, that'd be very unusual, but it could happen. And if it did, the way you're setup on self-insured, you'd have to pay the bill. So, you could have ten $100,00 payments you had to make, in addition to the premium you're paying

for the reinsurance, and the rest the of claims you're paying for the rest of the group.

So, you can run some very large numbers there. So the reinsurance company's to help you with that, knowing that if that happened it would be a very unusual thing. They will sell what's called aggregate. A lot of times in large groups, it's referred to as sleep insurance.

Just so that you're sure that you've locked in the most something could cost you. And so, aggregate insurance usally is done by your reinsurance carrier. It'll be under the same contract. They'll simply figure what you're expected claims are going to be.

They wanted 25 percent do that can come up with the spec or a number that your entire group as in aggregate as a total together did reach if the reach that number then they would go ahead and pay a 100

percent any bill from anybody from that point forward so let's

take our same example here two hundred thousand dollars back let's say we have

two hundred employees are units and in it it was a year expected claims are going

to be this billion dollars misuse use that as

a with 200 units that might be a little

bit low but no depends on where they rapin in the US

that our rates right now yeah we had that so

say here two million dollars is you're expecting claims they will set this back raid the that

aggregate raid at a hundred in are in it 1,000,000 and 250,000 so if you reach 1,250,000 in overall claims they will now go in P all clients even if you have someone that's never

met any of their deductible even the first five dollar they meet the

reinsurance cure basically will kick in and pay the additional on all a bit it using the that spec is

usually reached at a hundred and are 125 percent 25 percent more than

expected claims now they charge for that and that'll be

part of the quote that they would give you the %ah

give you a quote for the 100000 spec and then they'll give you a

quote for aggregate you can buy it with or without aggregate in like I said we call it

sleep insurance because most the time it does not use that you're ever in a case where you

have a lot of clinton's a large number of claims the end you'll

be really glad you bot aggregate because it limits your losses in so you can actually go into your

books in is the only only way you can figure on the

self-insured ok what your total budget could be is if

you have an aggregate on you grew gives them $1 million to $50 you know that's the most you're gonna

pay in addition to your third party administrator new PB

you know we should just pay in on a on a monthly

basis but you take that speck number one

million to $50 you add it to your TBA. Cost unit to your PB 0 that's the most it can cost you for the

year under self-insured if you have angered who it can be a very

good idea the smaller the group the more I

recommend going to an aggregate in it's simply

because usually smaller groups don't have the research to put in place to are set something that's Dennis

traffic k so a smaller group let's say YUM would

say we have bomb a lot of our overseas clients I

mean what you say we have you covered he units that are going to cover at

least some circles your allow what kinda but random amount dollar amount would

you I mean Justin general I mean ballpark mean obviously

we don't know the ages those people we don't know the club's history but adjusted just in general ballpark um what specific a what specific number are

we looking at generally what aggregate number looking

at generally is deductible let senator star Spencer

50000 100000 per individual per specific im when I do when you do a lot of a lot

brokers don't do this in I think they should andrew is coming into with the

pre-determined number so if they have a hundred or more than

90 say okay a hundred thousand is fine if they have two hundred or more than

they'll say in 150 to 200 is fine they may have a pre disposed number in mind on there's some brokers I would

tell you if you have 50 units you shouldn't be self-insured I is simply say you checked the market in you see once they hear so to tell you

what spec is right for you want that amount is I have to get the

numbers have to see what they are because your

group maybe younger in baby I'll very healthy et cetera there's a lot of

things that go into what the reinsurer what makes up the reinsurance quote then we basically put that into a

spreadsheet once we get those reinsurance numbers in we see what would happen for instance

I have several people that will tell me on a group of the you should go over sixty thousand

dollars in spec I would disagree and had a group B room just use me you little bit of allergies home trying

to know that I'm sorry but I have a group with eighty it for

several years have been on a spectrum a hundred and fifty thousand dollars but it's worked for that group in every

time the quote has come for the reinsurance

company we put it into a spreadsheet to look and how many claims they would have to

have how many those actually they have to meet igor

the premium paid was too much compared to a sixty thousand understand

a sixty thousand dollars but it's gonna cost you a lot more then a hundred and fifty thousand

dollars back just as a one thousand dollar deductible

plan cost you more than a five thousand dollar not play it's the same scenario you're just in larger numbers so I always look at what the quotas I'm I can see a case where 50 units could have a hundred thousand dollars

back it depends on the quote he and in that

case I would make sure they might aggregate in shirts with it when I would have that

in front of me so I be able to inform the client in an intelligent way so that they know

what it is so they know what their risk is and you know what's gonna happen in so I'm I am NOT one of those term I across the board there's just a

lot of folks out there that you're under 100 and size are gonna say

fifty to sixty thousand in Richards most the time I just tell you a little

secret there most the time brokers do look at commissions paid I know that's a

surprise for were some love you but they do in if they buy a lower spec 50,000 spec it's gonna cost you a lot more in you

see there's Commission bilby into that use each home when it's in the herd in

so if they're getting five percent let's

say I love that in Nome you know your premium is on 200,000 as opposed to a hundred

thousand they're gonna make twice as much as they

do on on that piece so that's why I put the numbers in from

the client in I do things that make it makes sense and you know I will put them at risk I

won't say where your group of 30 so must write two hundred thousand spec

who knows maybe it'll work this year maybe we'll

have a client no you don't do that in you should know in

self-insured there will be what they call the years 7 in after seven years you will have a bad

year it will happen in sometimes bad years

even come back to back because a lot and if you have someone

that has a large claim it may be ongoing in so sometimes those

aren't catch back to back the end so I don't 90 lay a certain

number and let the numbers tell me where to go

for that for that Klein wearing it yeah appreciate that that's really

the or the reasons why you know work with

you and have you up clients is so nice because I mean that

really is a sweet science industry background experience on the deck is it doing this for large

group for medium-sized its really is you know it's it's it's

refreshing and yeah I know it I notice I it's a

minute scene i've seen some other summer the ways you show that to clients

and and other breakdowns that not only in it

fully not going to self-insure does it was a little in cell culture but in up her please I'll find it but up partially self-insured that same thing

to help them really binder the sweet spot for them and there is the

slightest you have to be for the client mark I

mean that's it always takes care of itself but we really have a different gonna look at

it I mean I don't know what my company's new one

per se I don't look at it that way I don't go

you know if we would write this client then we would do XYZ. Idoney I look at the client's a you know

how can I help the client where that goes nope I may come to me and say hey let's

be self-insured I'm I'm looking at that lets go that route

in we may find out that the really can be partial self-insured but the really need to have what would

be normally known as fully insured product

in only have a two thousand dollar deductible in dude offer then it might make more

sense for them in by Silvestre someone that's very

young that has a lot of them you know very well people and they've

not had any claims and they feel like they're just foreign you know money into this big

insurance company and not realize anything it may make sense for

them no matter their size to go into a

self-insured product so again this be for the client units you know it's it's fine some christiana so we mentioned something

about these back to back claims her some no one in seven new starters on tape can

you top this little bit about I i know im stop-loss insurance

reinsurance there's you might hear these terms at 12

1215 12 $12.50 Nom just briefly he made the define the weather 15 well over 1250

would be in yeya somebody why that would be

important for somebody arm work itself insurance or so funding

most look a star let's start with the standard the

standard would be once referred to as a 12-12 contract means if

a claim was incurred in a 12-month period January through

December lets users an example they and the claim has to be incurred

from January 1 to December 31st and it also has to be paid from January 1 to December 31st that's a standard contract that will be

your lowest quoted contract in a lot of people will

say well that's not a problem I'll just do that well

here's the downsides a bit the a and number on the front we will only talk about

like the 15 12 yr 1515 understand and I well as go back to the

number how'd we get work well it just refers to the number of months

that is covered for the twelve on the front is for incurred

the twelve on the back is for paid oh now if I say 1512 that means we're going to cover 15 min

to be incurred whatever the dates are in that contract

in twelve months I love any so here's what happens so your brand new you're just going into

it your you're going to be 12 on the first

one is this going to be incurred in January to December you don't have to

worry about any time in the prior to January 1 because it's being handled by your

current company are whatever you're doing right now so we need run out claims and stuff that

may come from that are going to be taking care plan that

company so you're gonna have a 12 contract in your first contract if you

go who a self-insured typeof country then at the end up and that December 12 your cheapest reinsurance remember is

1212 so you're going to be tempted to in that at December 31st hoping because thats all you're doing hoping

that you will have a claim that incurs on let's say December 25th or 26th that's a catastrophically let's say a

heart attack as someone goes in form is in intensive

care and you have a period in there that you know you know it's not going to get

paid by time December 31st comes you know incurred there will be paid um now what's the chances of that

happening and that being very large it's pretty

small but I've seen it happen arm so what

happened with a group who had a 12-12 contract in a guy with Ian in December the 23rd any had the malfunctioning arm heart probably no. No heart monitor type: he and it got

infected they replaced it who they didn't get the infection

continued anyway without going into nuts-and-bolts they ended up with a two hundred thousand dollar claim in the

last part of that year their reinsurance was a hundred thousand

dollars though and they had two hundred thousand

it didn't kick in because the claim couldn't get paid by

December 31st remember the provider has to bill it has

to go through appo network up some Diet to get your

discounts the also verified that in fact it happen

me you know then to go through several things bien there's no way that is going to get

paid by December 31st so what happens is it doesn't meet the qualification at the

plan so it didn't pay ything in the school

had to pay that two hundred thousand dollars out-of-pocket because they were

self-insured um that can happen so how you how you

guardians that you may buy a 12 15 your first year in that's usually the one that i'm gonna

recommended that point this simply means it can be incurred in

the first 12 months but it can be paid over 15 minutes from

January 1 through March 31st so it should any claim even if stinker

December 31st should be able to be paid by December

31st expressions large plain gonna be aware then be there met I know

a lot of people that take the risk there you say when I am gonna pay that lower

now let me tell you sometimes you can find

the reinsurance company that will help you because what your intent with mine at

12:12 it's saving money right we all want to save money though

sometimes you can buy what's called an aggregating spec rape don't confuse that with everything else

ok talked about at this point B.

But it's where they may take those they

may take it and they'll say you pay three fourths over the premium for a hundred thousand dollars back he and if nothing happens then fine thats all UK. Then if you have a client then you will oh the premium with the rest of that 25

percent immediately in then we'll kick in at the

hundred thousand dollars so they give their premium if a claim

occurs after claim doesn't incur you get to keep it it's kind of a way

for them to share now that's not as you'll see it is often

today is she did at 1. Now once probably in 2002-2003 I was

very common you can find a lot of that I'm there are

companies still today that would do that you have to look for it but that could be mmm a way to offset mom that problem on the contracts now let's go the next step you bring new December 31st your your next january 1

so now this is your sexyy Ruiz now you want to make sure that there's

not a claim out there that has it been reported yet or you

don't know about so if you buy on your second year

08/12/12 that means if it's incurred January 1 going forward then it's covered well what if a claim incurred on

december twenty-fifth now your first contract you body 1250 well that's fine it went ahead and paid

for it if it went over the spec but if your renewal if you buy a 12

contract on the front Ian well if team let's say he just repeat

new by 12:15 again well any large claim that occur December

24th December 50 whatever that didn't have time to get

through the system is not covered so if those claims hit

you in January is not going to work any spec unless you

buy 15 50 now you're going to cover 15 months so

you can actually go back and you're going to cover anything from October November December that's

incurred and then for the entire year so January to December so that your fifty

Ian paid is 15 so it's going to be January 1

through March 31st to you so you may you should

buy your sexyy year probably at least if 1550 again I know folks that take the risk they

truly are self-insured when you take the rest there because there are suing and nothing's gonna

happen to them timing wise that would create a real problem iniki

so I'm always if you can do self-insured dude in such a manner that you can lock

in your risk I'm otherwise you're gambling you really

are gambling with dollars that in if you

don't have a very large reserve even if you do why do you want to risk

money when you can lock Indian know what your

risk years in be sure that it's there so those contracts to 1212 just make

sure you cover when is incurred in which made yeah and and Eli know specifically

there's this issue where special your national clients the OS. You get so many people coming home in so

many people's traveling for the holidays from from Thanksgiving onto the end of

the year and actually traveling back home were country they're leaving a recording

only expel home obviously right %uh but you know of their relief

worker there a you know their missionary you're there

I'm somebody teaching you know some school in Africa

someplace um lot at times get people traveling

over the holidays and so imagine you're saying is is very

relevant especially agencies that may not yet have really

train their people and a plan designed as a bit we've talked about before something you specialize in especially

if there are people who are coming home for treatment for things yeah and I they have a train them very

well so they're saving up all their medical issues till they come home for

the holidays and they want to know this treatment before they go back or is it and as really be a problem for a to z:

in just be aware we don't know how the rules are going to

come down but it is interesting if if the CIA makes it so that a returning missionary has 35 days in the

US and then they have to be on it 88 I play under whatever if if the or must back up Lesedi they come through as a rule that

says six months overseas is considered an expat in your exam from acha right without what you may see is a lot of folks that come home in

August were September in go back he and June or maybe because it carries over two years and

yet they can come close to the year be in there but they can still be six

months overseas so they're exempt in in that case if you have a lot of people coming home

toward the end of the year yeah you better make sure that you have

your coverage ride that them in in with missions guys also I just wanna not times a claim may be incurred wherever there

at in nobody knows about it for a while in it may take awhile for that claim to

come true it's not unusual for missionaries to turn inclined months

after the fact now you see those are smaller we're not talking major snow use if

there's a major dollar overseas I mean it's gonna be be even happier evacuation within its

era so hopefully you'll know your large

claims they're meant yeah you bring up some really good

points there just make sure that nom 3 if they see a forces everybody to you know can't come

home nom and certain period time in the house

be the into the year you you better make sure the year

contract ends in 15 at least on you may want to even up then

a little bit more I'm just two coverage but again premium pre-moderate we can put that all

together and we check it out in we see what makes sense in then you at least New Year s cool

into it so so I I liked it we do we touched a

little bit on laser an inherently sorry um agree that though any other things

you specifically can think up in terms of we've been talking now about

reassurances stop-loss but does specifically in terms of

international clients only one thing which was obviously I just brought up the fact international buyers

coming home lifetimes the holidays are traveling over how is that we talk about the fact that there that a lot of times

claims not to know about claims to later any other specific things about the

evacuation there were issues that you're national clients especially need to look at or smaller groups are

doing international were well as with money yes laser or read a statement well as self-insured plans and they say

well we're leaving our own plane so we really don't have to worry about where the claims are incurred in plan design

there's is huge in who if your self insured with

a hundred fifty thousand dollars back plan is just plain design is just as

important for you there as if your mind the five hundred dollar

deductible from you know I MGR at nursing it doesn't really matter you need to look at the

International has a large ppl so that it normally have claims are

incurred overseas they're cheaper than they were in the US.

The USO them Burgess highest place to get medical care people from all over

the world come here for care they do bennett not paying for in the same thing

with your plea in so really if your gonna send up

self-insured make sure you talk to someone in we

specialize in an I'm just making sure your plan design is

such that you're going to get the lowest cost for your claim Dollar that speed we have

group in art fifty to sixty percent other claims

are overseas in its amazing when they are there are a

lot of times their way below what their premium use their p in so if that's true with fully insured you can see what he would do all sorts

of insurance a plan design huge deal most people don't talk about okay so once again just summing up that

the international firm my they might be able to go with different amounts specific up area where simply because they're

dealing with overseas and or in their plan designed again set up in such a way where com maybe there's people treated differently if their

overseas as far as let's pay purses but stated that they come back to

you estimate that rumor if a if an international sending you would do the right plan design then I'd

be very comfortable with raising the specter great um because a lot of times those two

corley because if you get more claims over sees

you're gonna pay less warm and then if you have a larger energy you your claims just aren't very much um

with the rest of the group so you really wanna handle higher spec

on this in in Payless premium for the reinsurance

so now they are they they go together it's the know some

people do one will do the other meant it it well just not no is not one or the other so

yeah if you do self-insure them machine international city no

relation probably has a leg up on a normal company in the US. As the key and yet a beeper Diskin my

hand the claims overseas yeah at the same time though they may be

taking 10 bias and doing what study on the internet that's talking about so

funding it's a time it's basically the same so

coming from the basis other US company with claims in the US not

necessarily people overseas resources site as we talked about what

their party administration how important it is to get international no expert international dv8 aim same

quarter are trying to reach is or is a Showtime

are that that will have a GPA in the US. That they don't even know how to convert

many his between companies because what mister T

PA. Know it's a just a TV in their private

very good de Baux wet because there may be friends with

the organization or whatever their use in somebody to do their GPA

work that basically encourages everybody come home because that's where they're PBR network

is and that's where their claims are they understand in it becomes a hassle do international

claims coming from overseas so it's almost discouraged within the group well now you're almost assure yourself

that you're never 100 percent your claims in the US.

You know the nationalization I'll on the

money the years ago socialite more to say yeah those that that's a huge and

hopefully we'll address that on the website as well and talk about that

that's that's critical they don't this all that we talked a bit

about Lisa M and how when so many years later for a particular member of their group

or maybe your family in the area but

there's a at issue is running their family how they get laser diode or they're

being held hostage basically at that point if I could use this terminology by

the reinsurer because they kept their

insurance that point and now it's three times the amount that %uh percent

I'm be armed talking to yourselves any

recommendations on her insurer that it doesn't have a

history going out or made clear to him that well give us a couple ideas how can companies

or delays or as a template design is it in artists out all in the secrets of the

working with you are there some things you can say that we just hope our people under yeah I it's a secret sauce I'm its barbecue Redskins the city you

know I'm not really while the ladies ring really doesn't have

anything to do with plain design per se arm in really the only way to avoid it is out front planning is the plane ride in have the right company um some international companies will

guarantee renewal okay in they'll say we don't laser so that's a good way to go however now when they say that they will rescue so if you if you had a lot of large

claims they may not laser you no but your reinsurance me double from one year to the next you know it's it's better to find a reinsurance

company few key in that simply says we won't laser your

group in they'll put that in writing in his

party the plan document that that your best way there is really everything else is gonna I'm secondary

to it or like most people do is they just take

the risk and I'm I'm amazed how many people don't

even know till Asian can occur with them until it happens and yet let me just

give you example how that works with you we had a group ET units that we

were talking to you I mention lasering justina you know in

the visit well it is up at the end he told me

about a laser that he had to deal with you know the lady in

the office who was covered underneath their international plan I was pregnant he and just to the

renewal time near the renewal month: over their plan she had a preemie well that was a bad time because the reinsurance company came back input

on laser on the baby 972 thousand dollars because they knew it was a 28-month baby

or whatever they knew is going to be in their long-time in you don't intend seek ear neo-natal

unit in the US I mean your fifteen to twenty-five thousand per

day the you can run in those periods now you

may get some discounts from that meant is still gonna add up very rapidly in

that particular case what happened was the husband didn't

work for the unit in so they changed the baby in the

first 30 days over to his insurance so that employer got hit with it instead

the sending organization mine isnt organization what will you

done if you got the 972 what we've done they did not know they didn't have the

money they didn't have the reserves no one has those kinda reserves

necessarily to get hit by that so I just backed up

to at the beginning you have to send an

upper right in the only way to really really clarify on on Lee's remains just doe I'm my reinsurance from a company whose

going to laser you are who has it in a plan that the Kia in most of them do so may limit your companies you you kept from miss bill it's definitely worth it if it

happens no well worth is in the city it happens to you can't go anywhere you

can't do anything I can said previously i mean what are you gonna do with a 972

thousand-dollar laser you can't go to another reinsurance

company in and going to take you you can't go fully insured because

they're not gonna pick up that preemie so they're going to refuse you so your

stomach in so if they had my head the husband

working somewhere else they went ahead a penny 972 thousand

dollars plus all their normal operating costs

and all the other expenses on you most that could break a company ok spongier eighty so kinda brings me

back to that conversation we talk about on size you have to be aware that the smaller

the group the more you must make sure you don't

get lazy you know and I'll learn what's up that's daunting hearing that story

knowing this the care that we have here that you all have two words you know these groups especially you

know they're working or see is what I. Was doing great basin things on shoestring budgets

and am it almost makes me diste just want to tell everybody is the

partially so concerned about his book interests but Chris Carey but to is just lastly is have you noticed there's

any more common or less common not least ring in relation to

international them US. Laser in yeah no ranchers I'll majoring in mainly because most reinsurance carriers are

international carriers a 12 lund I mean that speaks for itself no White Mountains reinsurance is owned

by a serious international I'm Sweden um a lot every insurance companies are

very large there obviously their billion-dollar companies

I'm you know that cover risk and across the

board and Amy cover a lot more things in health risk

okay I'm using do there will be no backup P&C

carriers proper in Calgary carriers go back lots of things like that so I'm no I don't see really much difference it's just if your group is in the US. Nom in in most year people are getting

claims in the US.

Your ability to get to the high numbers is greater then if most your group is

overseas so that that's the only thing I would

say the air on on that laser impeachment know their

laser just based on you know we just based on their contract if they can

get you to agree to it you taking the risk they're not so it

did keeps their dude sorry he keeps their I'm renewal times happy

for them they are not cute costly as I said last

year but here's the here's a largely and I then all will do another 10 is on

now reserves and I think I'll important for

people to catch as well but I'm kinda like got credit now when you have a when you when you're

borrowing money and get bad credit very good thing requires

something how long will usually something take up say he's somebody had an issue cancer but its its over they've got a

clean bill of health they had free me um hit a huge bill but the you know obviously the babies

are born healthy in another how long does there's a through for

reinsurance the can't go anywhere else that next

year because obviously they have this huge crime how long we are sure people going to ask

how long to take for a company to get back in good standing with a cam n shop

around the inner armour back to be clean again it depends on the

key answer that you that it was in most cases cancer that is

cancer if you're cancer-free for more than five

years that's a typical rule of thumb and if you're more than five years they

won't count against you but I'm trying these days is a few actually have a letter from your doctor that requires you to be cancer

free then they use the don't hit you as hard they will take a chance on you at that

point so they may not but against the entire group as far as a

premium it's the same day I'm there are different preemie sorry

you can have ones I have ongoing issues and this members us up templates in des moines

iowa there were seven other me now we're born route I love those kids

were fine in the year to dampen they were in the

hospital for I believe it is almost a year before

they came out but then from that point on those fire in C. There's 20 2010 ongoing medical

treatment so it really depends on on what happens so a preemie can be just as adverse to you as as eighty

answer keys on so again in stitches piece by piece in in the hearings yes go back to know

the more information you can get on it in get to your to your insurance carrier or to your carrier is is the same rule the more information you can get there

on that you know some people will tell me well I don't want to ask any questions

about that stuff hate you can ask questions on your employees if if you learn some through the health

plan you can share with somebody else you can certainly find out as much

information as you can on something that goes on within your

employee base nom just for the fact that being able to

get your costs down so find out if somebody is going to be

treated any more not find out if they have that letter

that since Aon cancer-free I'm it will help you a lot on renewal in your age group here may not give you

a 75 percent increase in in or may get rid of a laser if you can

prove that in fact the rich then the girder ours not going

to happen so great question yeah so so does not

necessarily a year or two it its usually a bit longer than that going

to be banned yeah totally depends on them you may

have a cancer cases you know it's been ongoing for three

years and now they're cancer-free a reinsurance chair looks and it has

been won the group for a long time for something you've been quoted with them in for three years may have it wanna do

well in Union a cancer-free letter from the

doctor know certain they're like K listener the

game in is so they give you quoted will help you either your current carrier to stay down or come down or you may want to move

Richards here you can go in go with a new it was on whether the laser you're not 7

you well wonderful thank you so much deal

for just a wealth advice and information I think I hope this is helpful to our clients

I'll do we have a number of these are questions sorry there are looking at self-funding already have been self

funding for a while and considering somebody's various issues

whether it be the if they don't photo policy interests that or I'm where they're looking to you are

finally reassures carrier or there is issue so thank you so much I I

hope this is helpful and obviously I know you're available up

they can reach you through a good neighbor people have clients Decatur illicit boat GHR stock ombre obviously just go to the website if they're not are there already

I'm so-called publishers Takayama the graph paper there as well white

paper on I'm stop loss reinsurance they might also

help but to the I thank you very much and I will 40

questions long as as we can thanks sir thank you he said but I..