Mergers and acquisitions is the new vogue in the medical overall healthiness insurance coverage business correct now. Five of the height medical overall healthiness insurance coverage companies in the united states of america deserve to merge and accumulate. The peak overall healthiness insurers are merging and this is able to maybe induce lesser notwithstanding bigger medical overall healthiness insurance coverage organizations. Financial complications, reimbursement considerations and science expenditures has ended in a merger in the medical overall healthiness insurance coverage business. This switch will have an outcome on the prospects, medical overall healthiness insurance coverage companies, clinical employers and employees.

What does the merging between the medical overall healthiness insurance coverage organizations recommend precisely?

The merger in the biggest medical overall healthiness insurance coverage business is a daring switch which would possibly create an analogous form of frenzy that Obamacare did. The worldwide locations peak 5 medical overall healthiness insurance coverage organizations are merging which would maybe induce 3 big medical overall healthiness insurance coverage organizations. These mergers will make explicit that every one medical overall healthiness insurance coverage organization concerned in the merger will bring one thing common to the table. The bigger medical overall healthiness insurance coverage organizations deserve to build up the smaller medical overall healthiness insurance coverage organizations on the comparable time as the smaller medical overall healthiness insurance coverage organizations deserve to merge.

What is the distinction between a fantastic merger and a foul merger?

There is decent and horrific to each little aspect. Health insurance coverage merging can both turn out to be a boon or a bane dependent on what it brings to the prospects. A decent merger is the one where the businesses will make bigger the well worth of healthcare for the advance of its prospects. A horrific merger is the tournament which discourages rivalry and doesnt actually improvement the prospects.

What does it recommend for the consumers and others?

The merging between the biggest medical overall healthiness insurance coverage industries will in honestly fact have an outcome on the consumers/prospects and other oldsters concerned in the medical overall healthiness insurance coverage business.

Hospitals and medical government - Hospitals and medical government arent precisely appreciative of the merger between the big medical overall healthiness insurance coverage organizations as they agree with that this switch can discourage competitive behaviour. They agree with that bigger overall healthiness plans and schemes will have higher manipulate of provider networks for that reason reducing their payments.

Consumers - When the merger between the medical overall healthiness insurance coverage organization transform delivered, a worry cropped up amongst everybody. A worry that the merger will have an outcome on the provision and affordability of medical overall healthiness insurance coverage for the consumers/prospects.

Listed lower than are a host of of the resources how medical overall healthiness insurance coverage merger will have an outcome on the consumers:

Cost - The first hypothesis while the merger transform delivered transform that it'd induce an make bigger in the premiums making medical overall healthiness insurance coverage super-priced. Higher premiums can be troublesome for the consumers.

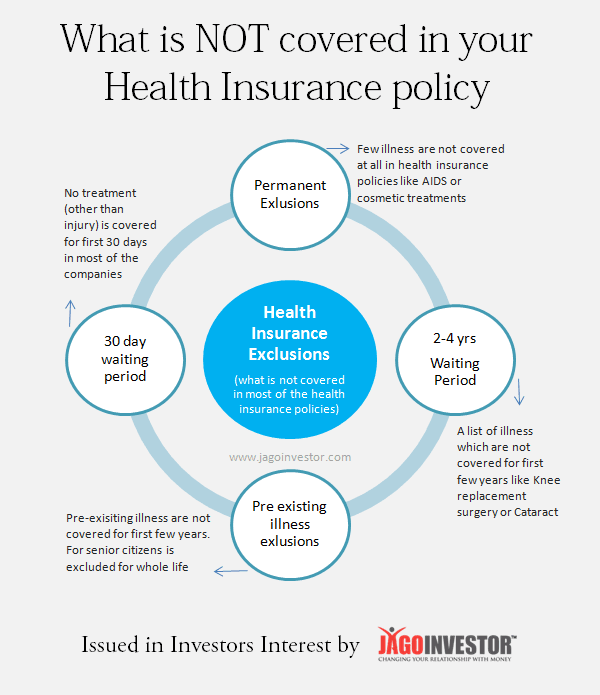

Reduced probabilities - There are going to be 3 (or so much less) foremost medical overall healthiness insurance coverage provider in position of 5, as a consequence of the merger. The merger between these insurance coverage organizations effects in fewer probabilities for the consumers to come to a decision from. The jstomer will have costlier and narrower probabilities while it contains medical overall healthiness insurance coverage after the merger if the charge of the premiums are speeded up too.

Reduced cowl -The merger would maybe in the decrease cost of the kind of hospitals and medical government that come lower than the plan insurance coverage.

Did Obamacare fuel the medical overall healthiness insurance coverage merger?

Obamacare has been a boon to the medical overall healthiness insurance coverage business as it speeded up its revenue with the aid of making it beneficial for everyone to have insurance coverage. Obamacare has in honestly fact helped in increasing the revenues notwithstanding there hasnt been so much distinction in the margin of the revenue. Acquiring and merging is many of the least complex how one can grow margin and thats precisely what the medical overall healthiness insurance coverage organizations are doing. Obamacare in honestly fact acts as the catalyst for the merger notwithstanding it with out doubt plays no function in passing of the merger.

Which are the height 5 medical overall healthiness insurance coverage organizations competing for the merger?

The peak 5 organizations aiming to merge and accumulate are listed lower than.

UnitedHealth

Anthem

Aetna

Humana

Cigna

UnitedHealth is aiming to build up Aetna on the comparable time as Anthem is aiming for Cigna. Aetna and Cigna had been rumoured to be taking on Humana which put itself on the market.

Who would possibly be hit hard with the aid of the merger?

The merger will function a infrequent blow to private purchasers beautiful than small venture. The upward push in premiums and the distinction in major quality after the merger will have an outcome on the non-public purchasers who will may want to pay more for medical overall healthiness insurance coverage dissimilar from what they'd opted for to begin up with. Small organizations are not affected so much with the aid of the merger as the distinction in the premiums can be lined up with out so much quandary.