Health Insurance in vintage refers to a policy that covers scientific expenses, although to boot be used to clarify insurance pointers for disability or long term care. The most primary premise is that the explicit human being can pay a small periodic premium in develop of major scientific care and the scientific insurance can pay all or a lot of the extraordinary, monumental scientific invoice on the time the care is required. What expenses are the explicit human being's nuclear circle of family members projects?

The first significance attached to having fitness insurance is the premium. This is the volume that the explicit human being can pay on a per month groundwork to in achieving the fitness plan. These kind largely dependent on what classification of plan you in achieving.

Another significance you'd like to comprehend almost is the co-pay. This can number from $0 to $500 dependent on the plan and the provider you are receiving. A neatly confer with, as an instance, can also significance you a co-pay of $30, on the similar time as a confer with to the emergency room is also $50. Each plan and commercial producer has its very own negotiated checklist of co-can pay so to think of that to research heavily when evaluating plans.

An crucial significance you're keen on to comprehend almost is the deductible. This is the volume that you'd like to pay out-of-pocket every frame and yearly turbo than your plan can pay the remaining. For instance, if your deductible is $500, you'd like to pay all scientific expenses a lot like fitness care provider visits, blood work, and pharmaceutical purchases up to $500 turbo than insurance can pay the first dime. At that point, you turns into responsible for any co-can pay. Every yr you'd like to get started accruing your deductible turbo than the insurance can pay for scientific expenses.

You can also have a plan that does not have co-can pay. You can also although have coinsurance that demands you to pay a percentage of the scientific invoice. Your scientific insurance can also canopy eighty% and also you perchance responsible for 20% of the invoice. These plans exceptionally have an out-of-pocket best possible which can likely be the principle an insured would ought to pay turbo than insurance kicks in to pay a hundred%. These limits are discipline to an annual accrual.

Some scientific insurance coverage have insurance policy obstacles. This can also imply that the plan will most productive canopy expenses up to a given dollar volume for a explicit provider. It can also imply that the plan has an annual or lifetime save away from for praise for the insured. Once the save away from has been reached, there are no greater praise paid by method of the insurance commercial producer and the policy holder will then be stable. These limits are consistently beautiful high principally if the save away from is a lifetime save away from.

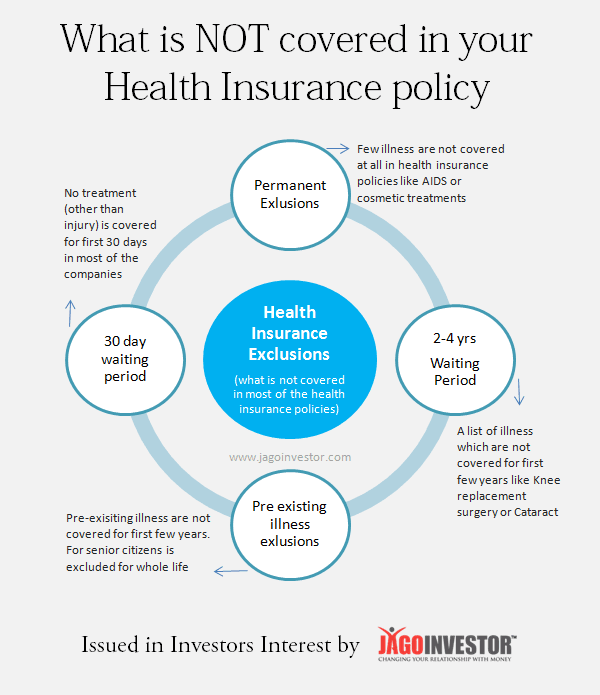

One last facet you recollect almost is that practically all plans have many desire exclusions. These are amenities or exams that mostly are no longer coated underneath your plan. An instance is also that many desire plans don't canopy maternity in any way or at some level of the first yr of the policy. Another provider that is also excluded is also amenities for intellectual fitness.

It is pretty crucial to contemplate the expenses and the praise of the insurance pointers heavily once you occur to're capable to pass along with your fitness insurance.