the Affordable Care Act, or what some people call Obamacare. But like many things in life, your health

insurance can often be confusing and complicated. Whether you've been insured for years or you're

new to the game, understanding your policy is important to your health...And your wallet. First things first, you have to pay your premium

every month or your insurance could get cancelled - kind of like your cable subscription.

You can also think of it like a shared health

care piggy bank -- we all chip in each month, even if we're healthy, so the money is there

when we need it. If you get insurance at work, your employer

probably pays most of your premium and the rest comes out of your paycheck automatically. If you have Medicaid, you most likely don't

have to pay any premium at all -- the federal government and your state take care of that. If you're insured through a new health insurance

marketplace, depending on your income, you may be eligible for a tax credit that pays

a portion of your premium.

Once you have that shiny new insurance card,

you'll want to try really hard to keep it in your wallet! To better your odds at staying healthy, be

sure to take advantage of the free preventive services that all new insurance plans provide. But of course...Stuff happens. And that's

when insurance really comes in handy. Now, having insurance helps a lot, but it

doesn't mean all your health care is going to be free.

There are lots of details about your insurance

plan that affect how much you pay when you get sick or injured. If you have Medicaid, a lot of these services

could very well be free. Otherwise, you'll likely have to pay something

when you go to the doctor or fill a prescription. This is called a copay when it's a specific

dollar amount -- like $25 per visit...Or coinsurance if it's a percentage of the bill.

There's also the deductible -- that's how

much comes out of your own pocket before your insurance starts paying. Depending on your plan, you might have a deductible

for all your care, or it might only apply to some types of care, like hospital stays

and prescriptions. So read your plan material, because it can

run into the thousands of dollars! Another important part of your plan is the

out of pocket maximum. This is the most you'll ever have to pay in any one year.

At least

for the benefits your plan covers. Your insurer will pay 100% of anything beyond

the maximum for the rest of the year. It can be just as confusing dealing with prescriptions!

Your plan has a list of drugs it will pay for, called a formulary, but the prices vary. Check with your doctor or pharmacist, because

a generic drug might fix you up the same as a brand name drug, but the price difference

could be huge.

So, those are the costs typically involved,

but remember that they'll be affected by your insurance plan's provider network. This is a list of doctors and hospitals that

are connected to your plan. Insurance companies negotiate discounts with these providers. Stay in-network, and the discounts get passed

to you.

Go out of network, and you could end up paying

full price. And remember that out-of-pocket limit? It

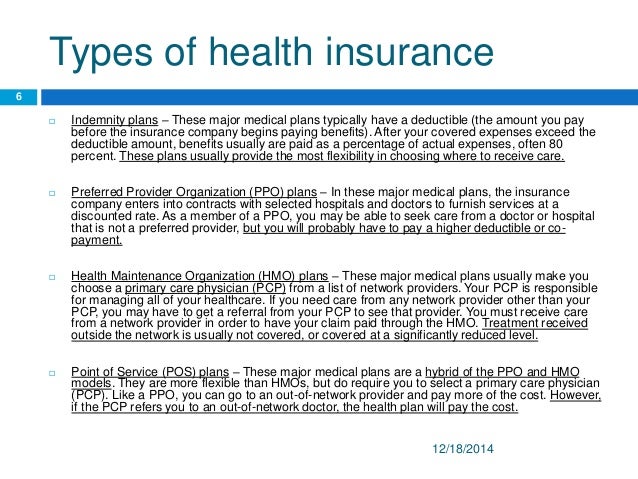

won't work if you go out of network! In some plans -- like HMOs or EPOs -- your

insurance would pay nothing if you go out-of-network. In other plans -- like PPOs -- your insurance

will cover you no matter where you go, but you'll pay a lot more if you go out of network. Also, if you want to visit a specialist - like

an orthopedist - some plans require a referral from your primary care doctor.

Sound easy enough? Well, sometimes staying

in-network can be tricky! In a hospital, it's possible that your surgeon

could be in-network, while your anesthesiologist is not. Don't be afraid to negotiate with your provider

or file an appeal with your insurer. So as you can see, there's a lot to think

about when you choose an insurance plan each year. Some plans may have low premiums, but fewer

doctors or hospitals and high deductibles.

There are tradeoffs, and understanding and

choosing among plans isn't always easy. Remember, if you have questions call your

health plan and ask, or check with your hospital or doctor. If you still have questions, your state insurance

department or Consumer Assistance Program can help. With the Affordable Care Act, there's new

support for consumers, so take advantage of it! Having health insurance protection is a good

thing, especially when you know how it works.

We hope you're now better prepared for the

next time you have to pull that health insurance card out of your wallet. Stay safe, America!.